Turn £10,000 into £3,800 - GUARANTEED!!

An unusually technical and numeric squib but sometimes we need to get in the weeds a bit

Friend,

In communicating with clients, financial advisers have to caveat almost every other sentence with "capital at risk", "past performance is no guarantee of future returns” etc. I can’t write a client birthday card without a footnote saying something about “future birthdays are not assured.”

If only our chums at The Treasury/HMRC had such obligations.

This week I had a phone call/email conversation with a client who is being headhunted to run a small organisation. It’s a lifestyle career change and she’s taken a considerable reduction in remuneration. Her headhunter thinks her package will be a salary of around £100,000 to £110,000. The lady is bright, driven, on her game - and like most of Civvy Street - completely baffled by our insane tax system.

Maybe thanks in part to years of listening to my witterings she knew that there was something fishy around the £100,000 salary mark. In her previous role, she didn’t really have to worry about it; her package was considerably in excess of this and there wasn’t much she could do. In her email to me she wrote (my emphasis):

So, I’ve done some research and understand that I might be better off at £100k because of the personal allowance 60% effective tax band.

I then saw something about pensions and salary sacrifice but, I’ll be honest, jet lag and no coffee made my head start hurting.

What she was alluding to was the litany of joy that happens when you hit £100,000 in earned income:

You continue to pay Income Tax at 40%, rising to 45% on every penny over £125,140

You continue to pay National Insurance (NI) at 2%

The killer: for every £2 over £100,000, you lose £1 of your Personal Allowance (the PA is that £12,570 sliver of income which the State so kindly decides not to pillage). When your earnings exceed £125,140 your PA is gone.

I could add that earning one penny over the magical £100,000 also completely removes you from getting any tax-free childcare. But I don’t want to rub it in and, anyway, things are bad enough already.

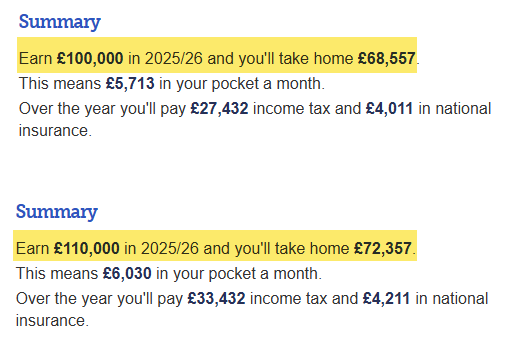

So I ran the figures for my client. Given the confluence of griefs above, if she earned £100,000, her net would be £68,557. If she earned £110,000 her net would be £72,357.

And it’s always net income that we need to focus on. To paraphrase Confucius: “People don’t live off gross, they live off net, and don’t ever forget it, Sonny Jim.”

There you have it: £10,000 effortlessly turned into £3,800. The Income Tax Trap (ITT). A miracle!

Salary Sacrifice: A Short Lesson

I’m all for a spot of alliteration now and then but “salary sacrifice” remains a grisly use of the English language. One could shorten it to “SS” but that has gruesome connotations. In essence, salary sacrifice typically means giving up some dosh for a pension contribution from the boss.

In our example, my client is very likely to take a package of £100,000 salary, with any excess left on the table being routed back into a personal pension as an employer contribution. This gives her £10,000 in her pension pot (where it grows free of tax, of course, although such growth is not guaranteed - bloody hell, there I go again) or £3,800 in her bank account.

£10,000 v £3,800: what would you do? Yes, the pension can’t be accessed until she’s 57, and some of it will be taxable at that time, and future governments might do this and might do that. And obviously each individual’s complete financial picture needs to be taken into account (BECAUSE NONE OF THE ABOVE IS ADVICE, CAPISCE?)

But, really, £10,000 or £3,800? It’s a no-brainer.

It Gets Better

My client’s prospective employer pays 15% Employer NI on employee salaries over £5,000 a year. This “unseen” tax was made considerably worse by Rachel From Accounts in her vomit of a Budget last year. If my client is offered a package of £110,000 salary, her employer has budgeted for paying Employer NI at 15% on the majority of it.

So, should she go the “salary sacrifice” route, the employer is saving (£10,000 x 15%) £1,500 that they have already accounted for in their offer sheet. So the employer could and should add this saving to the pension contribution.

Now the choice is £11,500 in her pension pot, or £3,800 in her bank account. And let’s face it, £3,800 does not a long way go these days: The Lovely Penelope (TLP) has a fondness for Jo Malone, a brand currently selling candles at £59 a pop. I have a fondness for beer, currently going for around £8 a pint in town. Go for one extended bender involving candles and beer (I’m adding this to The Bucket List as I type) and the £3,800 is pretty much gone on a long weekend of molten wax and hops.

[Your author departs for a cold shower]

OK, I’m back.

It’s Not Just Her

I posted my client’s story on X (the artist formerly known as Twitter). It hit a nerve and currently has nearly 1,000 “Likes”, over 150 Reposts and nearly 40,000 views. This, for me, is uncharted territory.

The striking thing is the tone of the comments. Normally social media brings out the antagonism in people (Lincoln goes to look in the mirror). Here, though, there is uniformity in criticising our tax code and the ITT in particular.

Multiple stories of people turning down work or working fewer hours to not earn more than £100,000. People asking to be posted to overseas offices where they can earn the same but retain a lot, lot more (net over gross, remember?)

The UK has a productivity crisis. GDP per capita (how much a country produces each year in goods and services divided by the number of producers) is at best stagnant and, as of last year, was below pre-Wuhan Lab Leak levels. This is distinctly sub-optimal. Any tax system that encourages the driven aspirational class (and that £100,000 salary is as good a marker as any) to work less or not seek that formerly attractive promotion is a disaster on stilts at many levels.

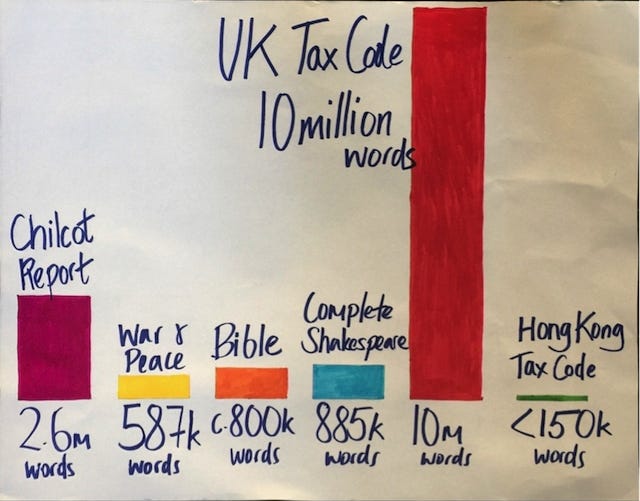

That many of these bright people are only at best dimly aware of the ITT is no reflection on them. The UK’s tax code is enormous. I could blind you with stats here but, truly, a picture says a million words (and the UK tax code runs to 10 pictures)

This is good news for accountants and bad news for human beings. In fairness, my accountant is a decent chap, although I’ve never seen him add up numbers without moving his lips, which is a concern.

As ever, this polemic is party neutral. Yes, the late Alistair Darling introduced the ITT in his 2009 Budget. But the Tories had 14 years to get rid of it and did nothing, not even raising the threshold (if the £100,000 had been increased in line with CPI over the last 16 years it would be just shy of £163,000 today).

The system is broken. Whichever party intimates they will reform our burdensome tax code has a decent chance of being lent my vote at the next General Election.

Until the next time.

I enjoyed this Nick. You put yourself down on the TRAP podcast for your technical skills but they shine through beautifully here. I was going to say that your colouring in was very good as well, but before I posted I checked to see that this was someone else's work. I am sure your colouring in is very good as well!

Very accurate and amusing as always. Why are pur politicians so stupid???